geothermal tax credit extension

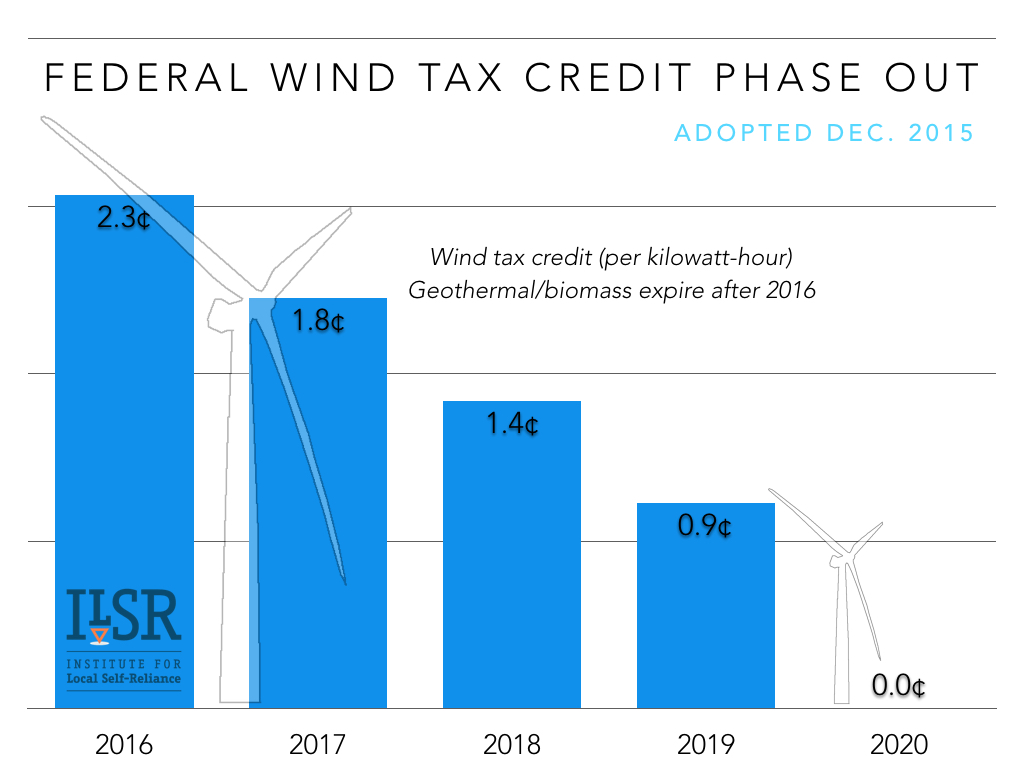

Congress authorized a 30 investment tax credit to be claimed on new power plants of up to 50 megawatts in size that generate electricity using waste heat from buildings and other equipment. What expenses are eligible for the Federal Geothermal Tax Credit.

Geothermal Heat Pump Tax Credits Approved By Congress Geothermal Heating And Cooling Chesapeake Geosystems

From 2017 to January of 2018 there was an ongoing fight to extended this tax credit.

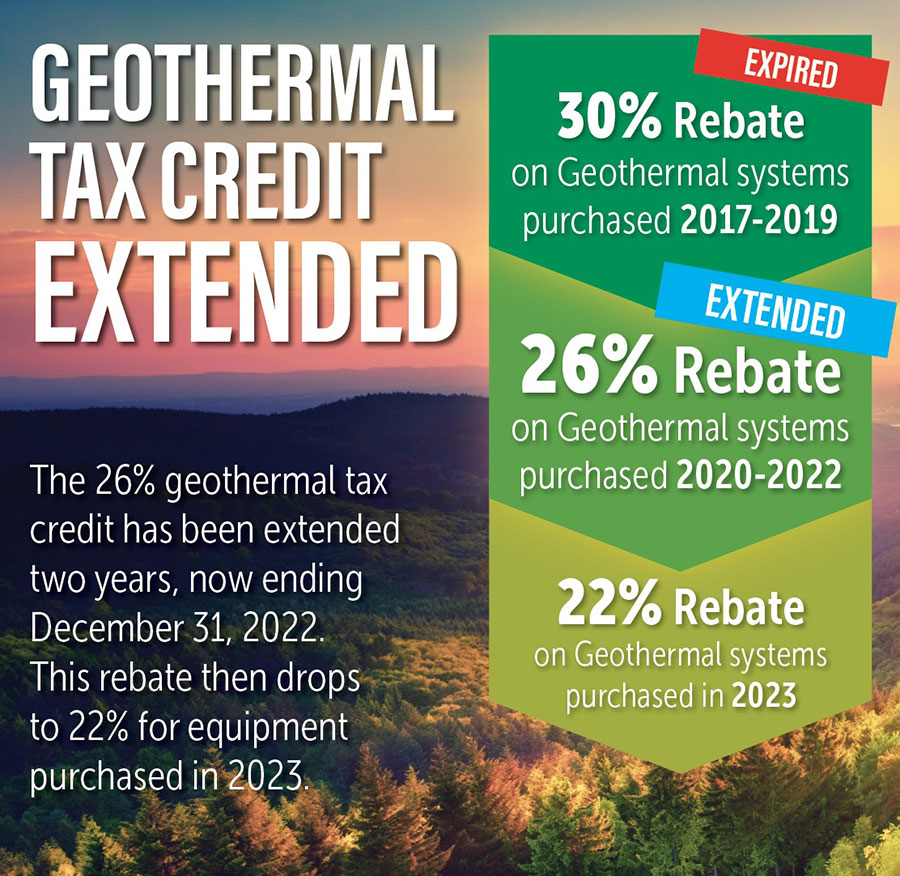

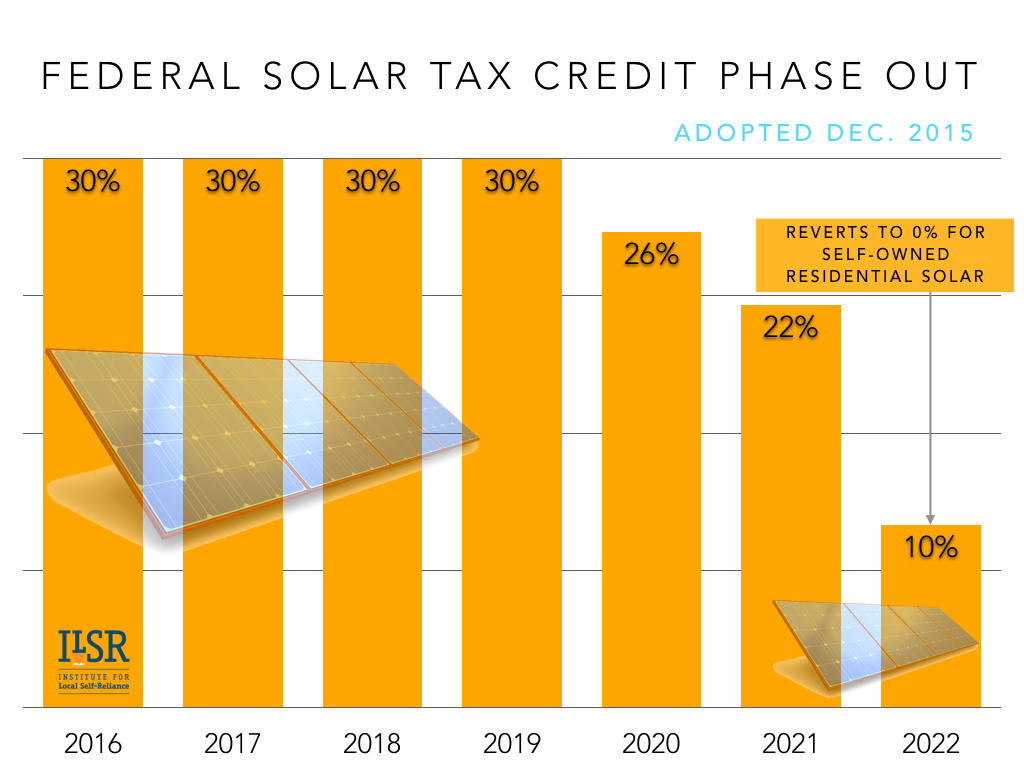

. The 26 federal tax credit was extended through 2022 and will drop to 22 in 2023 before expiring altogether so act now for the most savings. A 26 percent federal tax credit for geothermal installations was extended for two more years. Ultimately the tax credit was reinstated in early February 2018.

New geothermal heat pumps and combined heat and power projects will qualify for a 10 investment tax credit if construction starts by the end of 2023. Residential credits are 26 through 2022 then decrease to 22. In a massive environmentally-focused year-end bill congress announced on December 21 2020 that they would extend its federal tax credit for residential ground source.

A 30 tax credit for the installation of a ground source heat pump geothermal system with no cap was enacted in 2009. Ultimately the tax credit was reinstated in early February 2018. The federal tax credit for geothermal installations was extended for two more years at the end of 2020.

The Geothermal Tax Credit covers expenses including labor onsite preparation assembly equipment and piping or wiring to connect a syst. Provided your heat pump meets these minimum specifications the process of applying for a geothermal tax credit is simple. Residential Energy-Efficient Property Credit.

Christmas came early for the geothermal industry when the latest federal stimulus bill included a long-sought extension of tax credits for geothermal installation. The extension is good news for those considering the benefits of geothermal. You must also submit Form 5695 the Residential Energy Tax Credit.

For this reason you should consider helping this pass through. Commercial credits will remain at 10 through 2023. The credit has no limit and theres no limitation on the number of times the credit.

The extension keeps the tax credit at 26 for residential geothermal for 2021 and 2022. Geothermal equipment that uses the stored solar energy from the ground for heating and cooling and that meets ENERGY STAR requirements at the time of installation is eligible for the tax credit. Congress recently approved an extension of federal tax credits for both residential and commercial installations of Geothermal Heat Pumps.

Because they use the earths natural heat they are among the most efficient and comfortable heating and cooling technologies. The extension of the ITC will cover 26 of the cost of a Dandelion geothermal system in 2021 and 2022. Now geothermal tax credits will stay at 26 for 2021 and 2022 before falling to 22 in 2023.

Geothermal heat pumps are similar to ordinary heat pumps but use the ground instead of outside air to provide heating air conditioning and in most cases hot water. This Tax credit was available through the end of 2016. The 26 federal tax credit was extended through 2022 and will drop to 22 in 2023 before expiring altogether so act now for the most savings.

In December 2020 the tax credit for geothermal heat pump installations was extended through 2023. This credit is meant to incentivize home and business owners to install geothermal heat pump based climate control systems instead of more traditional oil electric or natural gas systems. Extension for commercial and residential geothermal heat pump GHP tax credits.

Geothermal Tax Credit Extended. In July a bill was introduced to the House and Senate to push for a five-year extension of the 30 tax credit for Geothermal systems. The credit then steps down to 22 in 2023 and expires January 1 2024.

In December 2020 the tax credit for geothermal heat pump installations was extended through 2023. Add-on components like ductwork or a new generator are not covered by the tax credit. As lawmakers hotly debate budget cuts and tax reform in Washington DC the Geothermal Exchange Organization GEO has formally asked the US.

It keeps the tax credit at 26 percent for residential geothermal for 2021 and 2022. In December 2020 the tax credit for geothermal heat pump installations was extended through 2023. As we mentioned before the geothermal tax credit goes through cycles of reinstatement expiration and renewal within the US.

This Tax credit was available through the end of 2016. February 18 2009. This would mean a 30 tax credit through 2024 a 26 tax credit in 2025 and a 22 tax credit in 2026.

Economic Stimulus Act Extends Renewable Energy Tax Credits. Since geothermal systems are the most efficient heating and cooling units available the United States federal government has enacted a 26 federal geothermal tax credit with no upper limit. Tax Liability Savings Explained.

Tax Credits For Geothermal Extended to 2023. Geothermal equipment that uses the stored solar energy from the ground for heating and cooling and that meets ENERGY STAR requirements at the time of installation is. This number will carry through until the end of 2022 and drops to 22 in 2023.

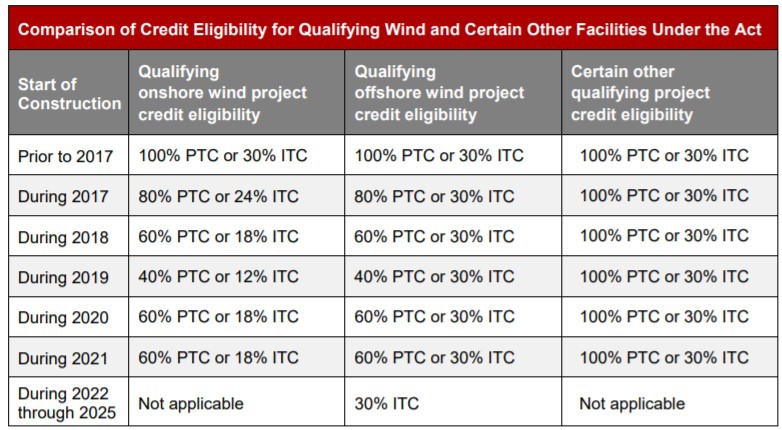

Property is usually considered to be placed in service when installation is complete and equipment is ready for use. APPLYING FOR TAX CREDITS. The tax section of the American Recovery and Reinvestment Act of 2009 which President Barack Obama signed on February 17 provides a three-year extension of the production tax credit PTC for most renewable energy facilities.

The percentage covered by the ITC will decrease to 22 in 2023 and 0 in 2024. The extension was part of the federal governments 900 million COVID relief package passed by Congress in December 2020. 31 2016 expiration date through.

In 2019 the tax credit was renewed at 30 of the total system cost which dropped to 26 in 2020. From 2017 to January of 2018 there was an ongoing fight to extended this tax credit. Federal Geothermal Tax Credits have recently been amended thus you may have 26 Federal Geothermal Tax Credits to get for systems installed by Jan.

A 30 tax credit for the installation of a ground source heat pump geothermal system with no cap was enacted in 2009. Electrical upgrades may also be eligible. Understanding the Geothermal Tax Credit Extension.

House of Representatives Ways and Means Committee to recommend extending federal tax credits for residential and commercial geothermal heat pump GHP installations beyond their Dec. The Geothermal Tax Credit covers expenses including labor onsite preparation assembly equipment and piping or wiring to connect a system to the home. Existing tax credits were set at 26 throughout 2020 22 throughout 2021 and falling to zero at the end of 2021.

The new legislation lengthens the deadline for the credits for GHP installations. In 2023 and expire January 1 2024. Help Extend The Geothermal 30 Tax Credit Through 2024.

Keep all receipts from the purchase and installation of your geothermal unit and submit them when its time to file your taxes.

Congress Gets Renewable Tax Credit Extension Right

How To File The Federal Solar Tax Credit A Step By Step Guide Solar Com

Geothermal Rebates Extended Corken Steel Products

2017 Geothermal Tax Credit Instructions Are Here

Geothermal Investment Tax Credit Extended Through 2023

Understanding The Geothermal Tax Credit Extension

Geothermal Investment Tax Credit Extended Through 2023

Nuclear Power Production Tax Credit Extension Bill Potential Vehicle For Orphaned Technologies

What Is The 2021 Geothermal Tax Credit Climatemaster Geothermal Hvac

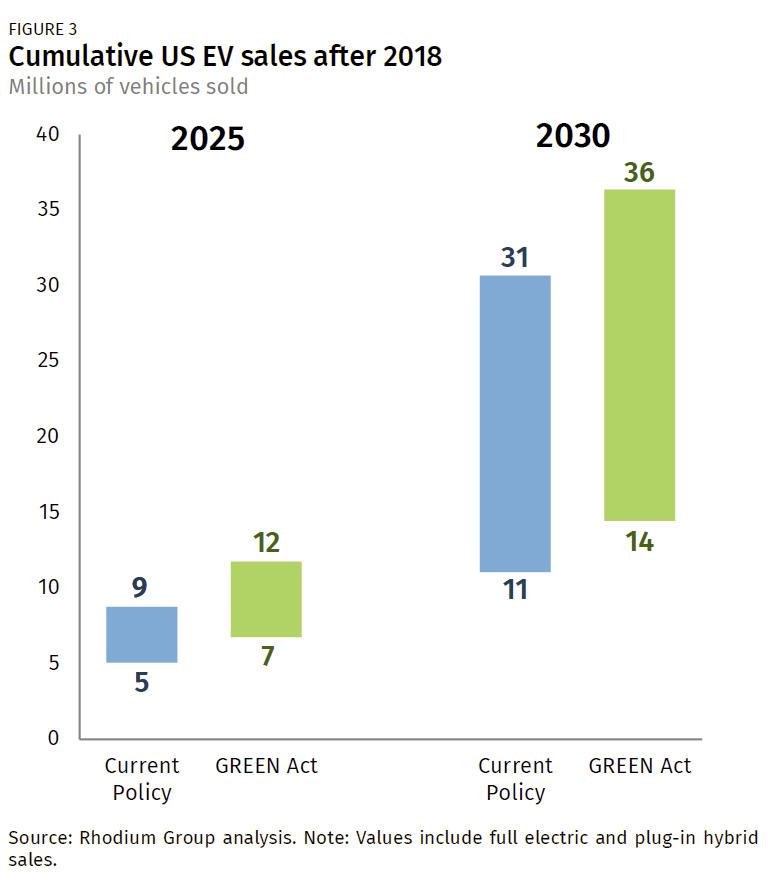

An Assessment Of The Green Act Implications For Emissions And Clean Energy Deployment Rhodium Group

What Is The 2021 Geothermal Tax Credit Climatemaster Geothermal Hvac

Tax Credits And Other Incentives For Geothermal Systems Waterfurnace

Congress Gets Renewable Tax Credit Extension Right

Geothermal Tax Credits Extended Smart Choices

Geothermal Tax Credit Extended Colorado Country Life Magazine

House Passed 1 7 Trillion Build Back Better Reconciliation Legislation Includes 325 Billion In Green Energy Tax Incentives And More Than 92 Billion In Spending To Address Robust Climate Change Goals Novogradac

Covid 19 Tax Relief Package Extends Renewable Power And Carbon Capture Tax Credits Lexology